Enterprise software vendors are subscription happy, but they’re delving into usage plans for customers too. Toss in some perpetual licenses and your negotiations with strategic vendors are about to get more complicated.

Enterprise software vendors are starting to mix and match their monetization models between subscription, usage, and licensing of some combination of all three, according to a Flexera report.

And that reality — driven by software providers’ hunt for profit margins and growth — is going to make your negotiations a bit tricky in the future. Get ready for a mix of payment models and vendors sniping at each other over monetization models.

Flexera found that enterprise software vendors are using subscription models for 74% of their products compared to 64% using perpetual licenses and 59% following usage-based models. Forty-seven percent of vendors are using outcome and value-based models. Flexera surveyed 321 software suppliers.

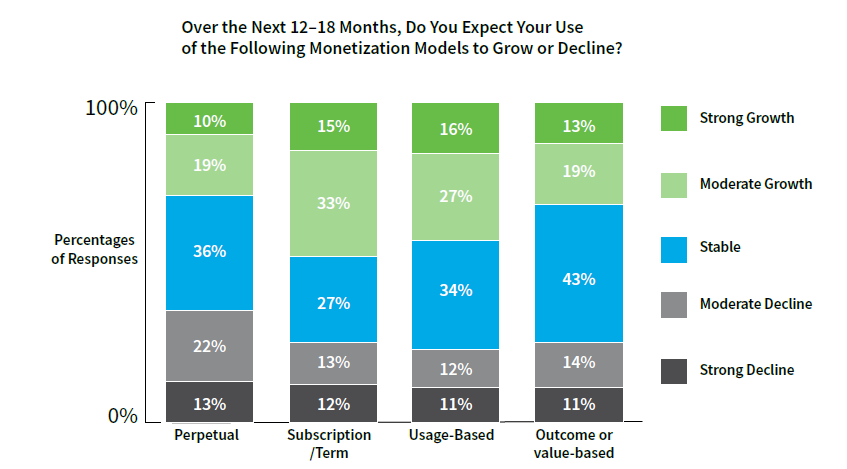

For sure, subscription and usage-based models will dominate over the next 18 months. Flexera’s survey found software vendors planned to grow usage and subscription models.

Where things get interesting is when subscriptions and licensing start to blend together. Simply put, there aren’t a lot of cloud puritans left. Microsoft has subscription and licensing plans and will blend them together. Salesforce acquired two companies in Mulesoft and Tableau that largely rely on licensing. SAP and Oracle have added subscription and usage models to licensing.

This hybrid monetization approach can work, but it could make deals less transparent. Fortunately, enterprises are used to it. Flexera found that 52% of respondents have moderate to extensive SaaS deployments, and 63% have moderate to extensive on-premise deployments. Internet of things devices will add a new wrinkle to usage monetization models, but only 35% of software providers thought they gathered product usage data well.

The challenge — and it is the same one that has haunted enterprise software forever — revolves around balancing price and value.

Rest assured there will be a few vendor scrums as these models converge a bit.

For instance, Microsoft recently previewed a new Azure Dedicated Host service that allows customers to run virtual machines in single-tenant servers. AWS and Google Cloud have similar service.

The catch is that Microsoft said users with Software Assurance could save money by using the Azure Hybrid benefit that can combine Windows Server and SQL Server licenses on Azure Dedicated Hosts. As of Oct. 1, however, new licenses without Software Assurance cannot be used in Azure dedicated hosting environments or other cloud service providers.

That blending of subscription, usage and licensing raised hackles of Azure rivals.

AWS used a LinkedIn post to highlight its Windows workload traction and said Microsoft’s Azure move was “taken from the old guard software vendor playbook.”

Google Cloud’s Robert Enslin said on Twitter that Microsoft was taking its vendor lock-in approach from the 1990s to the cloud. Enslin, who previously worked for SAP, took a few Twitter jabs for the reference given his former employer and lock-in approach.

Here’s what it means for the tech buyer.

- Get ready to wade through vendor FUD as these monetization schemes blend together.

- Every customer will have different mileage. For some folks, blending licenses and subscription with usage may make sense in a one-throat-to-choke scenario.

- Transparency will be key and rest assured that cloud providers and software vendors are all going to have gotcha moments embedded in contracts. Mystery is margin, and new compute platforms don’t change that axiom.

This article originally appeared on ZDnet.